Your Contact

Contact us:

Smart Estimates: High relevance for investor relations managers, 06.06.2017

Wiesbaden, 06. June 2017 – Weighted averages of analyst estimates have a very high relevancy in the work of investor relations managers and an even higher one for investors. This shows a recent survey of cometis AG among around 500 investor relations managers, most of which are from the German-speaking countries Germany, Switzerland and Austria. The survey took place from end of March until end of April 2017.

Database providers like Thomson Reuters are utilizing so-called Smart Estimates in their databases in order to weigh the estimates of individual analysts differently. Decisive for the weighting is among other things the historical accuracy of the respective analysts. The overall purpose of this survey was to inquire the meaning of the weighted analyst estimates among participants. Due to the very high response rate of just over 15%, the results are of great significance. The results in detail can be found below.

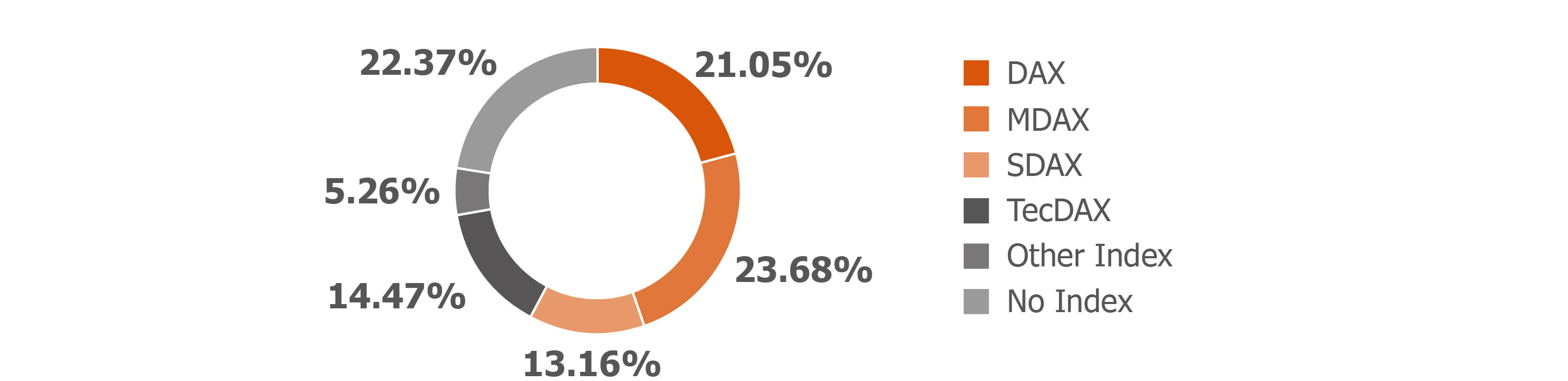

In which index is your company listed?

Participants: 76 investor relations managers took part in the survey, of which about 78 % are employed in index-listed companies. With almost 24 % of participants, the largest group of investor relations experts are from MDAX-listed companies. Approximately 22% are engaged in a non-index-listed company.

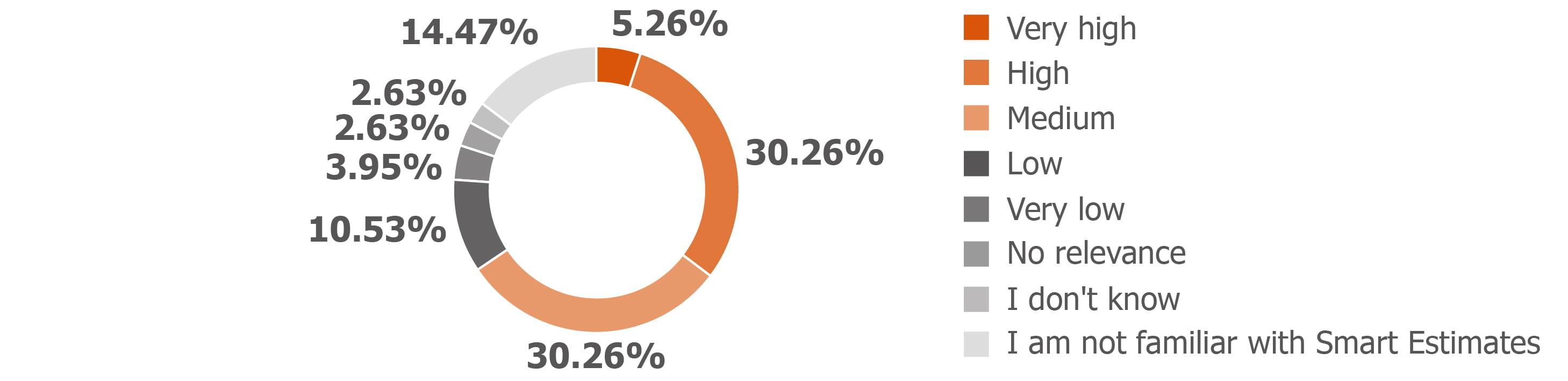

How do you assess the relevance of weighted averages of analyst estimates in your investor relations work?

From the IR managers point of view: Roughly 54 % of the participants assessed the importance of weighted averages of analyst estimates in their investor relations work as medium to very high. In contrast, approximately 32 % estimate the relevance of so-called Smart Estimates as low to not relevant. Around 14 % of participants are unfamiliar with this kind of processing of analyst estimates.

How do you assess the relevance of weighted averages of analyst estimates for investors based on your experience?

From the investors point of view: Based on their experience roughly two thirds of the investor relations manager estimate that for investors the weighted averages of analyst estimates have medium to very high relevancy and are therefore more important to investors than to investor relations managers. Approximately 17 % believe that investors attribute low to no relevance to Smart Estimates. In consistency with the above-mentioned question roughly 14 % of participants are not familiar with Smart Estimates.